Business Insurance in and around Sioux Falls

One of Sioux Falls’s top choices for small business insurance.

This small business insurance is not risky

Business Insurance At A Great Value!

When you're a business owner, there's so much to consider. We understand. State Farm agent Jill Van Ede is a business owner, too. Let Jill Van Ede help you make sure that your business is properly protected. You won't regret it!

One of Sioux Falls’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your take-home pay, but also helps with regular payroll costs. You can also include liability, which is vital coverage protecting your company in the event of a claim or judgment against you by a customer.

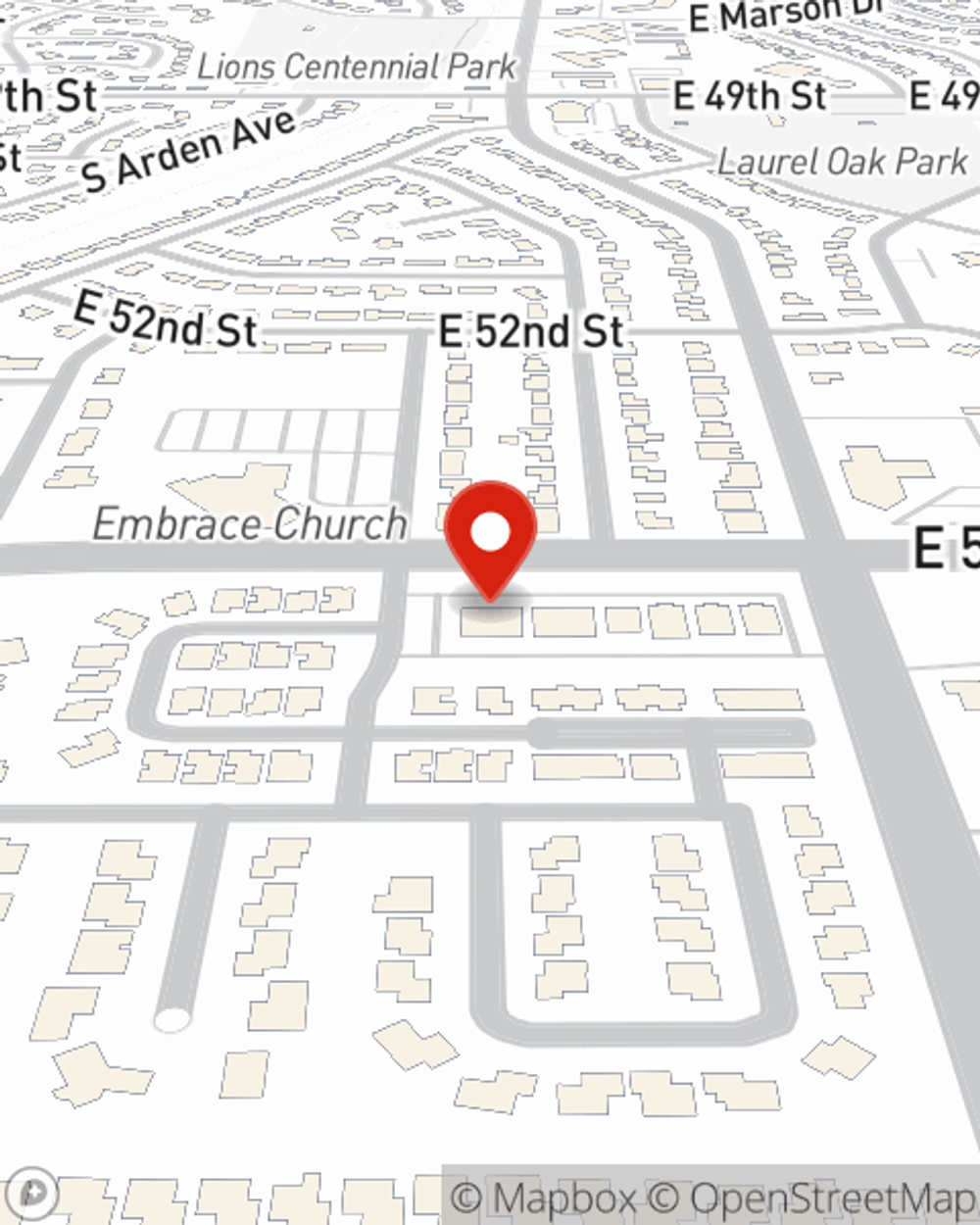

Call or email State Farm agent Jill Van Ede today to explore how one of the leading providers of small business insurance can safeguard your future here in Sioux Falls, SD.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jill Van Ede

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.